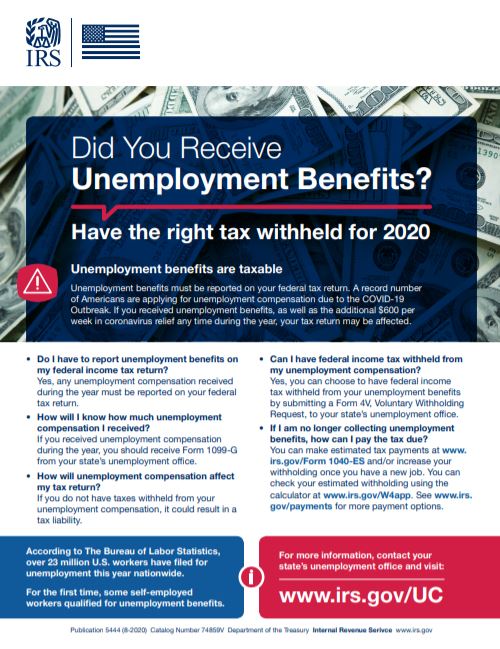

Do you know anyone who has claimed unemployment this year? As of April 2020, over 23 million Americans filed for unemployment, and one out of four Americans received unemployment this year. We need your help to reach these individuals and make sure they know that unemployment is taxable income. We do not want them to be caught off guard when filing their tax return next year!

Do you know anyone who has claimed unemployment this year? As of April 2020, over 23 million Americans filed for unemployment, and one out of four Americans received unemployment this year. We need your help to reach these individuals and make sure they know that unemployment is taxable income. We do not want them to be caught off guard when filing their tax return next year!

• Do I have to report unemployment benefits on my federal income tax return?

Yes, any unemployment compensation received during the year must be reported on your federal

tax return.

• How will I know how much unemployment compensation I received?

If you received unemployment compensation during the year, you should receive Form 1099-G from your state’s unemployment office.

• How will unemployment compensation affect my tax return?

If you do not have taxes withheld from your unemployment compensation, it could result in a tax liability.

• Can I have federal income tax withheld from my unemployment compensation?

Yes, you can choose to have federal income tax withheld from your unemployment benefits by submitting a Form 4V, Voluntary Withholding Request, to your state’s unemployment office.

• If I am no longer collecting unemployment benefits, how can I pay the tax due?

You can make estimated tax payments at www.irs.gov/Form 1040-ES and/or increase your withholding once you have a new job. You can check your estimated withholding using the calculator at www.irs.gov/W4app.

See www.irs.gov/payments for more payment options.